Peace of Mind Starts with a Plan

A Revocable Living Trust helps you protect

your assets and care for your loved ones

Revocable Living Trusts Made Simple

Considering how to manage and distribute your assets? A revocable living trust is one estate planning tool some individuals use. Below is a general explanation of how these trusts work in California.

*IMPORTANT NOTE:

*This is not to imply legal or tax advice. Consult a qualified attorney or tax professional for guidance specific to your situation.

What Exactly is a Revocable Living Trust?

Think of a Revocable Living Trust (often just called a "Living Trust") as a special container you create for your assets (like your house, bank accounts, investments).

**You create it while you're alive: It's a legal document set up during your lifetime.

**You transfer ownership: You move your chosen assets into the trust's name.

**You stay in control: Usually, you name yourself as the initial "Trustee," meaning you still manage and control the assets just like before.

**It's "Revocable": This is key! As long as you're mentally able, you can change or even cancel the trust anytime. You're not locked in.

**Goal: It helps you control your property while you're alive and allows it to pass to your chosen beneficiaries after your death, usually without going through the court process called probate.

(Note: While this type of trust helps avoid probate, it generally doesn't shield assets from creditors while you're alive.)

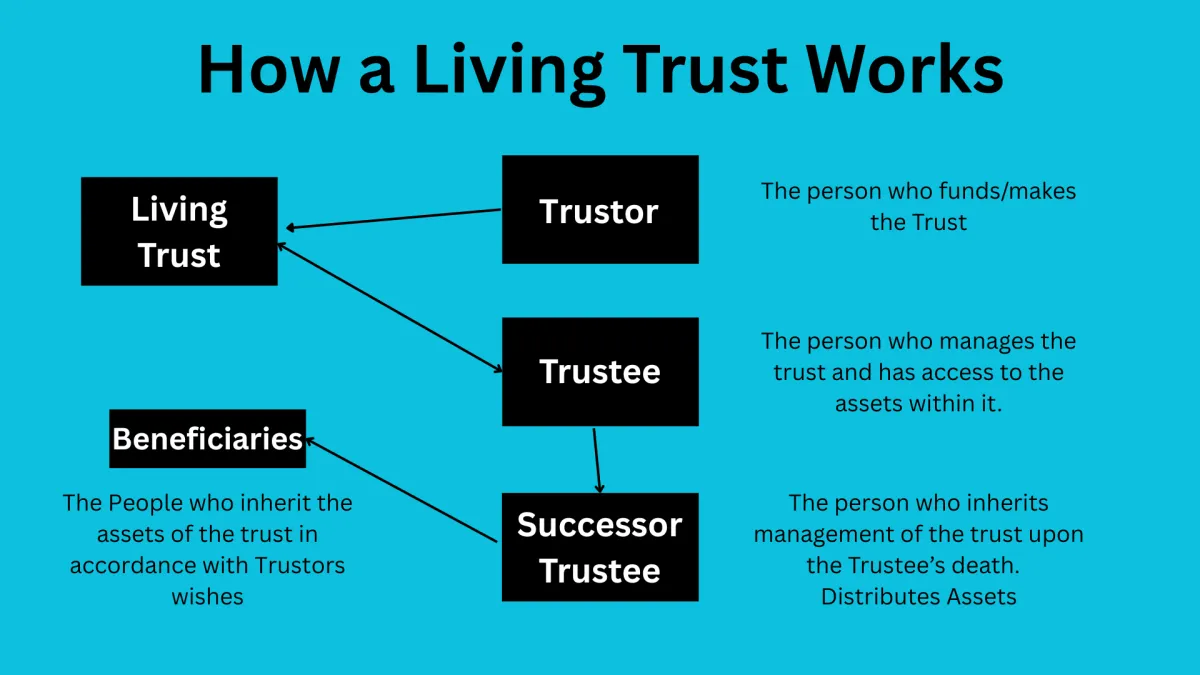

Who Manages the Trust?

**Trustor: This is the person who funds/makes the trust

**Trustee: This is the person (or institution) responsible for managing the assets in the trust according to the rules you set in the trust document.

**Often, the person who creates the trust (Trustor) acts as the initial Trustee.

**You also name a Successor Trustee to take over management if you become unable to or after you pass away.

**Beneficiary: These are the people or organizations who will ultimately receive the assets from the trust.

Why Would Someone Want a Living Trust? (Key Benefits)

Living trusts are popular for several reasons:

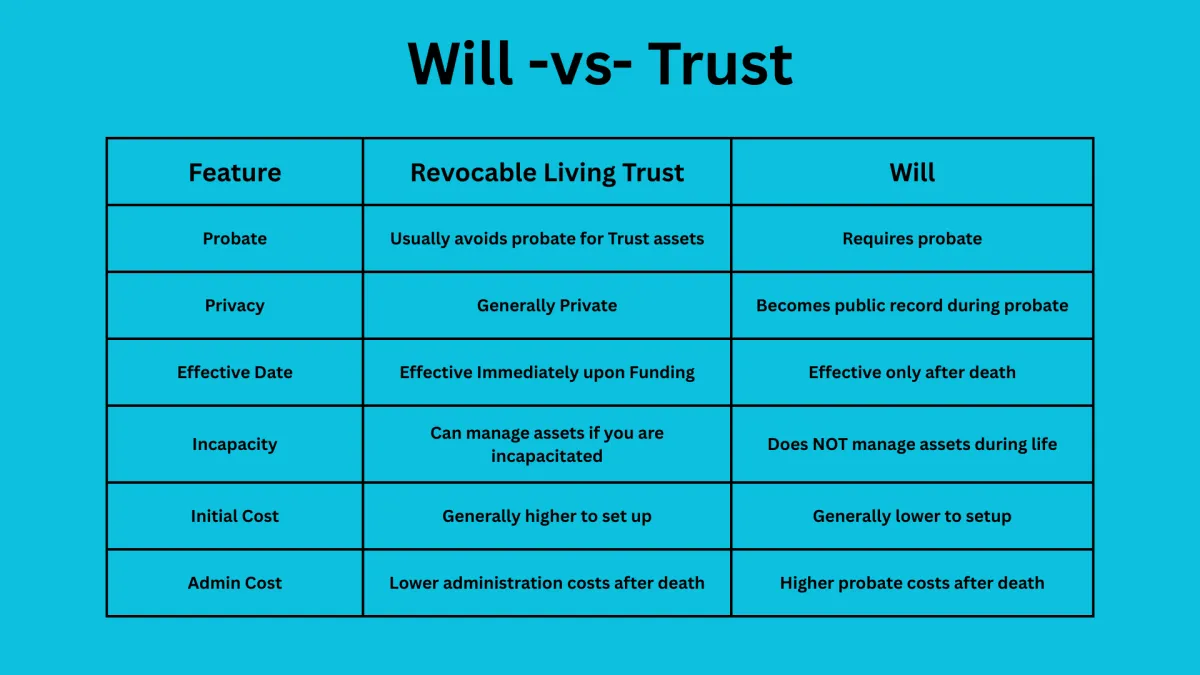

**Avoiding Probate: This is often the biggest advantage. Probate is the court process for settling an estate after someone dies. It can be slow, expensive, and public. Assets in a living trust usually pass directly to beneficiaries, skipping probate.

**Privacy: Unlike wills, which become public records during probate, trusts are generally private documents. The details of your assets and who inherits them remain confidential.

**Control During Incapacity:* If you become unable to manage your finances due to illness or injury, your chosen Successor Trustee may be able to step in immediately to manage the trust assets for your benefit, without needing court intervention.

**Flexibility: You can change beneficiaries, add or remove assets, or even dissolve the trust entirely while you're alive and mentally capable.

**Consolidated Management: It can simplify managing your assets, especially if you have property in multiple states.

Who Might Benefit Most from a Living Trust?

While many people can benefit, a living trust might be particularly helpful if you:

**Want to avoid the costs and delays of probate.

**Desire privacy for your estate settlement.

**Own real estate, especially in multiple states.

**Want a clear plan for someone to manage your finances if you become incapacitated.

**Own a business.

Setting Up and "Funding" Your Trust

Creating a trust involves more than just signing the document:

1. Identify Parties & Wishes: Outlining your wishes, naming trustees and beneficiaries.

2.Sign and Notarize: You (the Grantor) must sign the trust document in front of a Notary Public

3.Fund the Trust: This is crucial! Funding means transferring ownership of your assets into the trust's name. This might involve changing deeds for real estate, updating bank account titles, or retitling investment accounts. If an asset isn't properly transferred (funded) into the trust, it may still have to go through probate.

Important Considerations**Taxes:

For income tax purposes, a revocable living trust is usually ignored while you're alive; you report the trust income on your personal tax return. It also doesn't automatically save you estate taxes; the assets are still considered part of your estate for tax calculations upon death. *You should Consult with your Tax Professional regarding possible tax implications

**Irrevocability:

Your trust typically becomes irrevocable (meaning it can no longer be changed) when you pass away.

**Creditor Protection:

As mentioned, a revocable trust does NOT protect assets from your creditors.

**Living Trust vs. Will: Key Differences

Many estate plans include both a will and a trust. Here's how they differ:

Potential Downsides

**Initial Cost & Effort: Setting up and properly funding a trust takes more upfront time and cost than a simple will.

**Funding is Essential: The benefits (like avoiding probate) only apply to assets actually transferred into the trust. Forgetting to fund it is a common mistake

**No Income Tax Savings: Doesn't reduce your income taxes while you're alive

**Limited Asset Protection: Doesn't shield assets from your own debts.

Conclusion

Another vital step is informing all the parties of their future roles. Successor Trustees, Power of Attorney, and Medical Directive Custodian are extremely important roles and could have consequences with other family members. Making sure that all parties know their roles and what is required of them will help insure a more peaceful transition.

A revocable living trust may offer significant benefits like avoiding probate, ensuring privacy, and planning for incapacity. However, it requires careful setup and funding. Taking the time to think everything thru is essential.

Schedule a Free 20 minute

Discovery Consultation Call today to see how

MAX Estate Plan can assist with your Living Trust Needs

MAX Estate Plan - 20226 State Rd Cerritos, CA 90703

TOLL FREE: (833) 629-7526

(833) - MAX-PLAN)

MAX Estate Plan has entered into an arrangement with Snug, a third-party technology platform that provides a comprehensive estate planning solution. Snug allows users to create, manage, and administer estate plans through their digital platform. As part of our arrangement, MAX Estate Plan purchases access to the Snug platform, which enables us to invite or refer our clients to create estate planning documents for an additional cost. Snug's platform is designed to help clients create estate planning documents that align with the legacy objectives we have discussed and developed together. Once referred to Snug, clients enter the platform and are guided through the document creation process. As an advisor, I may assist clients in the role of a scrivener, helping to input client information and preferences into the Snug platform based on our prior discussions and the client's instructions. However, it is important to note that this assistance does not constitute legal advice, and the client maintains full control over the final decisions and selections made within the Snug platform. MAX Estate Plan does not draft, modify, or create any legal language within the estate planning documents. The legal content and structure of the documents are predetermined by Snug and their legal team. My role as a scrivener is limited to facilitating the input of client data and choices within the parameters set by Snug's platform. From a compliance perspective, offering access to Snug's platform and acting as a scrivener within the platform is similar to other estate planning referrals that MAX Estate Plan may provide. Snug prioritizes advisor compliance with industry best practices regarding legal ethics and professional rules of conduct.

Copyright © 2025 Max Estate Plan dba of Team Advisors Group, Inc- All Rights Reserved.

20226 State Rd Cerritos, CA 90703

Direct: 833-629-2272